🔅 When Insurance Gets Dark: The Grim History of Slave Policies

Yinka’s Vibrant Designs Are Getting a Makeover

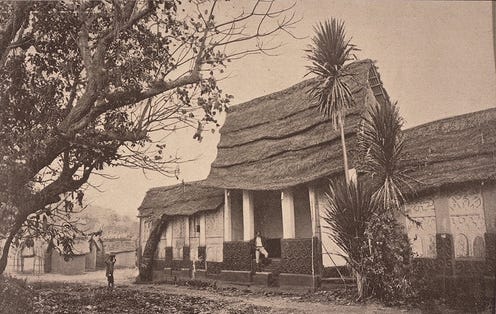

Image of the Day

Market Mondays

Year-to-Date Performance:

🟢 Johannesburg SE: 81,686.49 (+6.23%)

🟢 Nigerian SE: 99,671.28 (+33.30%)

🟢 Nairobi SE: 110.03 (+19.45%)

🟢 Ghana SE: 4,086.54 (+30.55%)

🟢 US S&P 500: 5,615.35 (+18.40%)

🟢 Shanghai Composite: 2,971.30 (+0.30%)

Shell wants to drill up to five offshore wells off the west coast of South Africa. Energy companies are shifting their focus south of Namibia, where there have been a series of prolific finds.

The IMF has slashed Botswana’s 2024 growth forecast to 1% from an earlier estimate of 3.6% due mainly to lower diamond production.

South Sudan's President Salva Kiir has sacked the country's finance minister who was just four months into the job. This is the sixth replacement in the post since 2020.

Ethiopian state-owned Ethio Telecom said that its full-year revenue and net profit rose by more 20% in the year that ended in June. Ethio Telecom said its total subscribers rose 9% to 78.3 million, while subscribers to its financial service Telebirr rose to 47.55 million customers from 34.3 million.

Zimbabwe has revised its economic growth forecast downwards to 2% from 3.5% as southern Africa's worst drought in decades ravages crop yields, but a bounceback in growth is likely in 2025. Meanwhile, in his first 100 days in office, Zimbabwe’s central bank governor accomplished a feat that eluded his predecessors. John Mushayavanhu has introduced a new currency — the gold-backed ZiG — that’s so far kept its value. The country has tried five other variants since the Zimbabwe dollar was first abolished in 2009.

The prospect of a business-friendly South African government has drawn foreign investors back to the country’s stock market, with inflows reaching levels last seen more than two years ago.

Moody's cut Kenya's sovereign rating deeper into junk territory, citing diminished capacity to implement a fiscal consolidation strategy to contain its debt burden. In June, Kenyan President Willian Ruto withdrew planned tax hikes in response to mass protests that turned deadly, killing at least 24 people.

*Data accurate as of the close of markets across the continent

Spotlight Stories

When Insurance Gets Dark: The Grim History of Slave Policies

Imagine your boss taking out a life insurance policy on you, except you're not an employee – you're property. Welcome to the twisted world of slave insurance in pre-Civil War America, where human lives were literally treated as assets to be protected... or exploited.

On April 20, 1859, a massive explosion rocked the Bright Hope Coal Pits in Virginia. Nine men died, including five enslaved Black men. The white victims got their names in the papers, while the Black victims were just... well, property damage. Indeed, those enslaved men had insurance policies on them. Worth about $29,000 in today's money, the payouts went straight to their "owners."

The Birth of Industrial Risk Management

Turns out, slave insurance was one of America's earliest forms of industrial risk management. Companies like New York Life, AIG, and Aetna were all in on this grotesque game. These policies weren't just about protecting investments. They were a stark reminder of how deeply dehumanization was baked into America's financial systems.

Enslaved people were seen as "liquid capital" – tradeable, rentable, and insurable. Their value appreciated until their mid-30s, and the rise of dangerous industries in the 1840s made slave insurance more popular. Owners could rent out their slaves for hazardous jobs and still be covered if something went wrong.

Even after slavery ended, the racism in the insurance industry persisted.

Black people were charged higher rates based on racist theories about their health and habits. And today, we're still uncovering the full extent of insurance companies' involvement in slavery. With most records lost, what we know is likely just the tip of the iceberg.

It's a stark reminder that when we talk about systemic racism, we're not just talking about history – we're talking about the very foundations of many industries we interact with daily.

Yinka’s Vibrant Designs Are Getting a Makeover

Yinka Ilori's vibrant designs are getting a typographic makeover thanks to a new collaboration with British Standard Type (BST).

The dynamic design duo has birthed a bespoke typeface that's equal parts British, Nigerian, and 100% Yinka. The resulting font family, cleverly coined "Yinka Sans Ultra" and "Yinka Sans Shadow," is a mashup of rounded and square shapes that pay homage to Ilori's dual heritage and multidisciplinary approach.

Inspiration for this typographic tour de force came from a smorgasbord of sources, including music, architecture, Nigerian folk art, and even contemporary pop culture.

The goal was to create a typeface that injects Ilori's signature sense of optimism and inclusivity into every letter, word, and sentence.

The designer is already putting his namesake font to work, using it for embroidered upholstery on his "Iya Na Wura" furniture collection. And this is just the beginning – Ilori envisions the typeface making appearances in future public art projects and exhibition designs.

But wait, there’s more!

Yinka Ilori has also teamed up with Momentum Textiles and Wallcovering to bring his signature explosion of color and pattern to commercial spaces near you. Say goodbye to soul-crushing beige and hello to walls that scream "I'm here to work, but also to party!"

Ilori's first dive into commercial textiles and wallcoverings is like a Red Bull for your workspace. The collection features three wallcovering patterns and five textile patterns, each available in a range of colors from "my retinas are burning" bright to "I'm adulting, but make it fun" neutral.

Ilori says the collection aims to "transform commercial spaces into playful, creative hubs that inspire, uplift and even heal."

What do you think?

Food for Thought

“When the roots of a tree begin to decay, it spreads death to the branches."

— Nigerian Proverb

Hi