🔅 Why is Mauritius a Millionaires' Paradise?

The Culprits of Africa's Debt? Not the Usual Suspects

Image of the Day

Good Morning from Eswatini

Last Week in Numbers

Year-to-Date Performance:

🟢 Johannesburg SE: 86,198.57 (+12.10%)

🟢 Nigerian SE: 97,432.02 (+30.30%)

🟢 Nairobi SE: 117.61 (+27.68%)

🟢 Ghana SE: 4,529.30 (+44.70%)

🟢 US S&P 500: 5,728.80 (+20.79%)

🟢 Shanghai Composite: 3,310.21 (+11.75%)

The Good News First

🌍 $2 Billion: Afreximbank is doubling down on creativity, literally. They're pumping up their Creative Africa Nexus (CANEX) funding from $1B to $2B over the next three years.

🇳🇬 $110 Million: Moniepoint just joined the unicorn club! The Nigerian fintech raised this hefty sum from investors including Google's Africa Investment Fund. They're profitable (gasp!) and eyeing continental expansion. Move over, traditional banks.

🇪🇹 🇰🇪 🇧🇮 🇳🇬 15 New Languages: Google's getting chatty with Africa, adding languages spoken by over 300 million people to its Voice Search, Gboard, and Translate services. Finally, Oromo speakers can ask Google the meaning of life in their mother tongue!

The Plot Twists

🇬🇭 🇳🇬 $400 Million: The amount Ghana spends monthly on European fuel shopping sprees. But that might be coming to an end, thanks to Nigeria's Dangote Oil Refinery, who they plan to purchase from going forward.

🌍 $75 Billion: African countries are paying this much extra in financing costs because credit rating agencies think the continent is riskier than it actually is. Talk about an expensive misunderstanding!

🇰🇪 $606 Million: Kenya's getting a fresh IMF loan tranche after passing their seventh and eighth reviews.

The Plot Complications

🇳🇦 3.6%: Namibia's revised growth forecast for 2024, down from 4.0%. Blame it on the diamond market slump and drought.

🇸🇳 $300 Million: Senegal raised this amount through a bond reopening after the IMF found some skeletons in their financial closet. The previous administration is being blamed, after an audit revealed that the country's debt and budget deficit were much wider than they had reported

🇿🇦 1.1%: South Africa's new growth target, down from 1.3%. Finance Minister Enoch Godongwana delivered this news with the enthusiasm of someone announcing a root canal.

Coming Soon...

🇦🇴 April 2024: Angola's Cabinda oil refinery is set to start production. It's over budget but ahead of schedule. The new project, which will be Angola's second oil refinery, will help make sub-Saharan Africa's No. 2 oil producer less reliant on costly fuel imports, especially as Angola aims to eliminate fuel subsidies.

*Data accurate as of the close of markets across the continent

Spotlight Stories

Mauritius: The Millionaires' Paradise That's Punching Above Its Weight

Mauritius may be small, but it's mighty when it comes to attracting millionaires. This tropical paradise is not just a pretty face – it's also a financial powerhouse that's been flexing its muscles on the global stage.

Forget about the Joneses – in Mauritius, it's all about keeping up with the millionaires. In 2024, more than 5,000 millionaires called this island home, making it one of the hottest spots for the world's wealthy elite. And according to investment advisers Henley & Partners, this number is set to double in the next decade.

So, what's the secret sauce that's drawing in the ultra-wealthy? It's a combination of high levels of safety, security, and stability – things that are harder to find than a needle in a haystack these days. Mauritius is like a bubble of calm in a world of chaos, and the millionaires are flocking to it like moths to a flame.

But it's not just about the peace and quiet. Mauritius is also business-friendly, with a robust legal system that combines the best of French and British law. And with no capital gains tax, dividend and interest withholding tax, it's a tax haven that's giving the millionaires a reason to pop the champagne.

The financial services sector in Mauritius is no joke - it contributes 14% to the country's GDP. And with private banking and family offices identified as the key to growth, the island is rolling out the red carpet for the world's wealth management community.

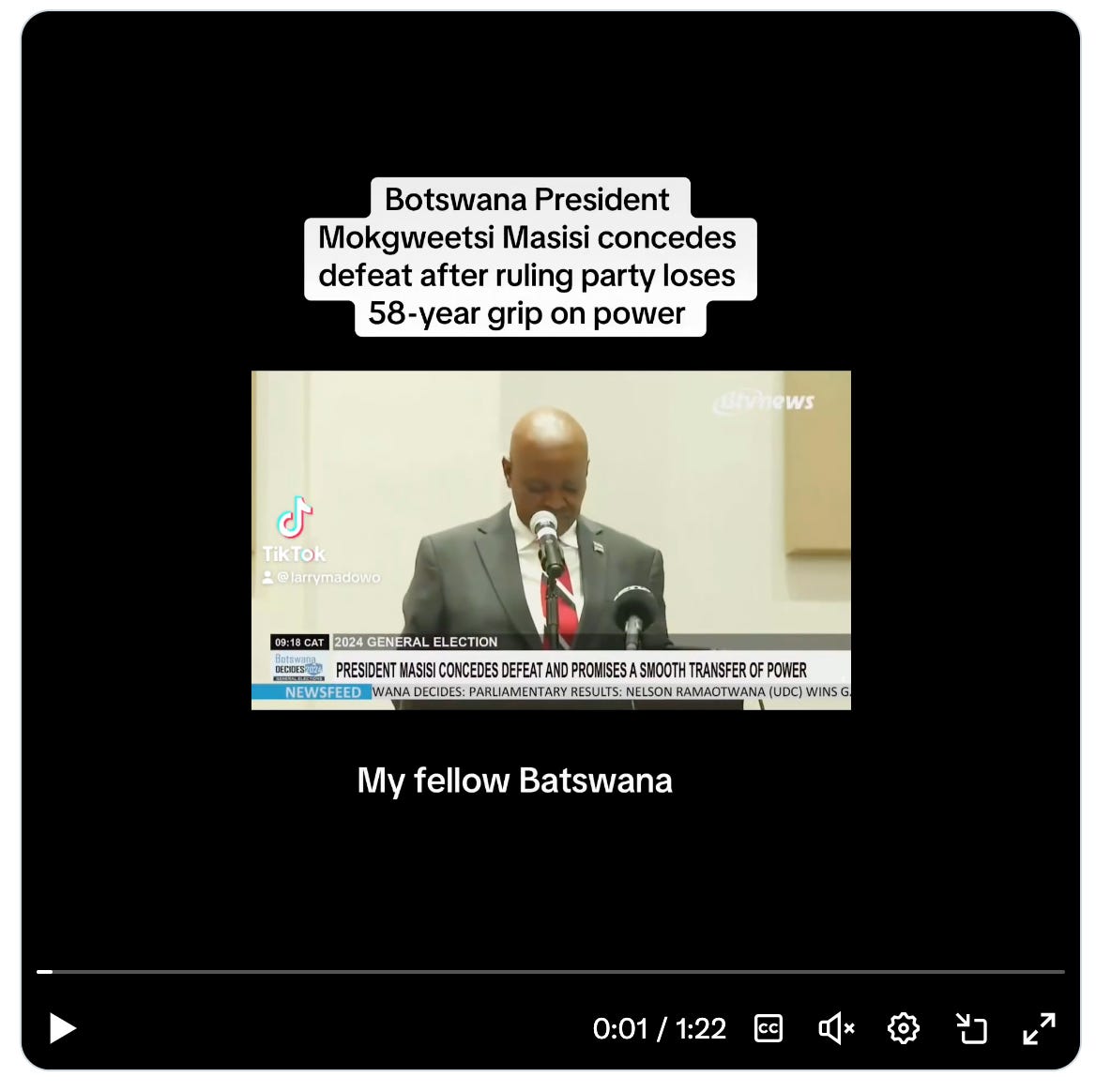

Botswana's Political Shake-Up: Out With the Old, In With the New

In a stunning turn of events, Botswana's President Mokgweetsi Masisi conceded defeat in the general election on Friday. This seismic shift marks the end of the ruling Botswana Democratic Party's (BDP) 58-year reign since the country gained independence from Britain in the swinging sixties.

President Masisi, clearly not one to drag out the inevitable, threw in the towel before the final results were even announced. It seems the BDP was trailing in fourth place, a humbling rejection by voters who were ready for a change.

The main opposition party, the Umbrella for Democratic Change (UDC), held an overwhelming lead in the partial results. Their candidate, Duma Boko, is set to become the next president of this southern African diamond powerhouse.

A Graceful Exit and a New Era: In a press conference, Masisi said he had called Boko to inform him of his concession. He even went as far as to say that Boko was now effectively the president-elect. Talk about a graceful exit…

"Although I wanted a second term, I will respectfully step aside and participate in a smooth transition process." He even promised to attend the inauguration and cheer on his successor.

While Botswana has long been regarded as one of Africa's most stable democracies and a post-colonial success story, the country now faces new challenges. A downturn in global diamond demand, which accounts for more than 80% of Botswana's exports and a quarter of its GDP, has taken a toll on the economy.

Unemployment has risen to more than 27% this year, and significantly higher for young people. The government has seen a sharp decrease in revenue from diamonds, forcing the adoption of recent austerity measures.

Even the BDP conceded throughout its campaign that policy change was needed. They tried to convince voters they were capable of leading the country out of its economic troubles, but it seems the people had other plans.

Ultimately, the Umbrella for Democratic Change's victory marks a new chapter in Botswana's history. For the first time since independence, the country will be governed by a party other than the BDP. Duma Boko, the UDC's candidate, is a 54-year-old lawyer who also ran in 2014 and 2019.

Africa's Debt Crisis: It's Not Just the Usual Suspects

You've probably heard the usual suspects blamed for Africa's debt woes: China, the IMF, the World Bank. But there's another culprit that often flies under the radar: private banks. These financial institutions are lending to African countries at exorbitant rates, making it nearly impossible for them to climb out of the debt hole.

Take Kenya, for example. The country is spending four times more on servicing external debts than on healthcare and education.

And guess who owns a big chunk of that debt? American banks like AllianceBernstein and BlackRock, along with a host of London-based institutions.

Much of this debt comes in the form of Eurobonds, which are like the payday loans of the international finance world. African governments often have no choice but to issue these bonds just to pay off previous loans, locking them into a vicious cycle of debt. And if they try to restructure their debts? The banks can sue them in London courts, thanks to the bonds being governed by English law.

The Loan Shark Analogy: Jennifer Larbie from Christian Aid puts it bluntly: "It's like a loan shark preying on people who don't have the money. If you've only got the option of going to the loan shark, you know you will get the worst interest rate." Private creditors charge interest rates that are double those of Chinese lenders and far higher than multilateral and bilateral lenders.

Even when countries do manage to negotiate debt relief, it's a long and painful process. Just look at Zambia, which took four years to reach a deal with bondholders like BlackRock after declaring bankruptcy in 2020. And even after the restructuring, Zambia will still be paying two-thirds of its budget on debt servicing for the next few years.

All of this debt has real consequences for ordinary Africans, and you can read up more on this here.

Food for Thought

“Good beginnings make good endings.”

— Ghanaian Proverb