🔅 Lesley Lokko's Architectural Revolution & Kenya's IMF Lifeline

Plus, Red Sea Ship Diversions Fuel Africa's Ports & West Africa's Mining Megaproject

Photo of the Day

Brief & Bright: Africa's Top Five

Lesley Lokko's Architectural Revolution: From Ghana to Gold Medal Glory

Guess who's breaking the marble ceiling at the Royal Institute of British Architects? It's Lesley Lokko, the first African woman to bag the prestigious RIBA gold medal. She's not your everyday architect. In fact, she doesn't design buildings at all. Instead, she's an academic, teacher, writer, and curator extraordinaire, dedicated to diversifying the world of architecture. Her work isn't about building structures, but building bridges in the profession, especially in relation to race and identity. Lokko, a true globe-trotter in academia, has founded two architecture schools - one in Johannesburg and another in Accra. She even spiced up the 2023 Venice Architecture Biennale by shifting the spotlight to Africa for the first time. This Ghanaian-Scottish powerhouse didn't have a straightforward journey. Born to a Ghanaian father and a Scottish Jewish mother, she was whisked off to boarding school in England, dabbled in Hebrew and Arabic at Oxford, then pivoted to sociology and law in the US, before finally landing in architecture. She has even written some steamy bestsellers along the way. Her latest venture is The African Futures Institute in Accra, a think-tank-cum-school with a nomadic studio in Morocco. Its aim is to rethink education for Africa's ambitious youth, tackle colonial legacies in curricula, and stay nimble in the face of rapid change.

IMF Throws Kenya a Financial Lifeline

Kenya just got a major financial boost from the International Monetary Fund (IMF), with $941 million to help ease its economic woes. The IMF's green light means Kenya can immediately pocket $624.5 million. The IMF's total funding commitment to Kenya now exceeds $4.4 billion. Why all this generosity? Well, Kenya's been showing some impressive resilience despite being hit by a double whammy of external and domestic challenges. The IMF’s funding is a nod to Kenya's efforts to keep its economy stable amidst these rough seas. But let's not forget the elephant in the room: Kenya's facing a serious cash crunch. There’s a big question mark over its ability to rustle up funds from financial markets before a $2 billion Eurobond comes due in June. The government's hoping that, along with some expected support from the World Bank and regional banks, this IMF dough will help them pay off their foreign debts without draining their hard currency reserves. The country's balance sheet has been under pressure from the lingering effects of the COVID-19 pandemic and frequent droughts, likely thanks to climate change.

Avoid the Red Sea, Fill Up in Africa: Ship Diversions Spike Fuel Demand

Ships are now swerving away from the Red Sea, making a detour taking vessels on a scenic route around Africa, which is also causing an uptick in bunker fuel demand in the most unlikely of ports. We're talking places like Mauritius and South Africa. Why the change in course? The Houthi attacks in the Red Sea, a response to the ongoing Gaza war, have raised the stakes in the Middle East. With the U.S. joining in with retaliatory strikes, it's no wonder ships are steering clear. This rerouting is adding a whole 10-14 days to ship journeys by cruising around Africa's southern tip to dodge drone and missile threats. John A. Bassadone, the big boss at Peninsula, a bunker supplier, paints the picture at ports across Africa, which are now facing bumper-to-bumper traffic, creating congestion and putting pressure on port infrastructures. Where there's demand, prices soar, with ports in Mauritius and South Africa witnessing a jump in bunker fuel sales.

Decades in the Making: West Africa's Mining Megaproject

In the remote corners of West Africa, a mining endeavour of epic proportions is set to launch after a saga spanning roughly 30 years. This colossal $20 billion project, centred around iron ore extraction in Guinea's Simandou mountains, is a coalition effort led by mining heavyweight Rio Tinto, the Guinean government, and China. The story starts all the way back in 1997 when Rio Tinto secures an exploration license in Simandou. Fast forward through a tumultuous journey peppered with legal hurdles, funding snags, and political instability in Guinea, including several coups. Now, Rio Tinto's Chinese state-owned partner, Chinalco, is on the cusp of receiving the final nod, setting the stage for construction to commence. The scope of this project is staggering: two iron mines, a 400-mile railway, and a port near Conakry, Guinea's capital. Given the scarcity of easily reachable ore today, grand-scale, intricate projects like this, backed by a consortium of investors, have become the norm. Rio Tinto alone is shouldering $6.2 billion of the project's cost, highlighting the sheer scale and ambition of this long-awaited West African mining megaproject.

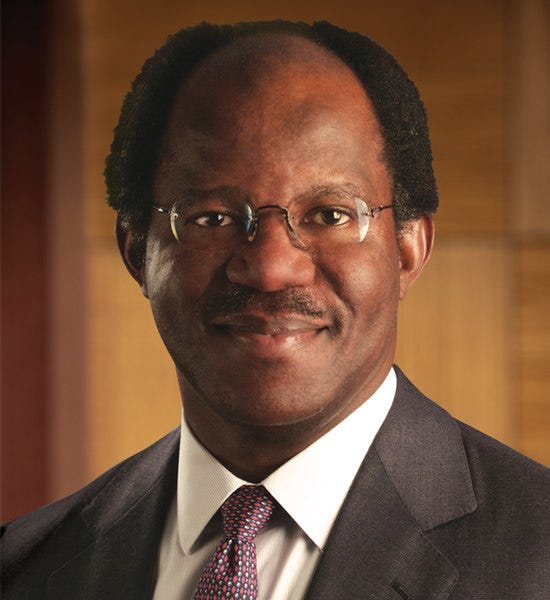

Bayo Ogunlesi: From Oxford Whiz to Billionaire Big Shot

Move over, most interesting man in the world, because Nigeria's Bayo Ogunlesi is here. This guy's resume is so stacked it could give a library a run for its money. First off, he nailed first-class honours at Oxford University, then, just for kicks, he snagged a law degree and an MBA from Harvard. Oh, and did we mention a little gig clerking for Supreme Court Justice Thurgood Marshall? But Bayo didn't stop there. He became the big boss at Credit Suisse's investment-banking division and even snagged a top spot at Goldman Sachs Group Inc. Now, here's the cherry on top: Bayo's about to join the billionaire club: his firm, Global Infrastructure Partners, which he co-founded and heads, is getting scooped up by BlackRock Inc. for the not-so-tiny-sum of $12.5 billion. Bayo, at 70, is making headlines, and Bloomberg has a write-up on him.

Food for Thought

“Advice is like a stranger; if he’s welcome he stays for the night; if not, he leaves the same day."

— Malagasy Proverb