🔅 Jumia Exits Food Delivery Service to Spice Up Core E-Commerce

Plus: Somalia's Debt-Free Dance, Ethiopia's Economic Tightrope, Mozambique's Gas-Powered Piggy Bank.

Photo of the day

Seychelles

Money Matters

🟢 Nigerian SE: 71,669.91 (+0.18%)

🟢 Johannesburg SE: 73,892.30 (+0.14%)

— Ghana SE: 3,130.60 (+0.00%)

🔴 Nairobi SE: 93.86 (-0.09%)

🟢 US S&P 500: 4,619.55 (+0.33%)

🟢 Shanghai Composite: 2,991.44 (+0.74%)

*Data accurate as of the close of markets across the continent

Brief & Bright: Africa's Top Five

Jumia's Menu Change: Exiting Food Delivery to Spice Up Core E-Commerce

Jumia Technologies, Africa's e-commerce bigwig, is about to flip the script on its business strategy. By the end of this culinary saga, Jumia Food will be no more in all seven countries where it operates. The plan? To pour all their energy into beefing up their main online retail game. In a world where everyone's watching their financial waistline, Jumia's going on a cost-cutting diet: trimming headcounts, waving goodbye to grocery deliveries, and scaling back on delivery services unrelated to e-commerce. It's all part of their master recipe to finally cook up some profits. Jumia Food, which dished out about 11% of the company's general merchandise value until September 30, has been simmering in a pot of non-profitability since it first hit the kitchen. Because imagine being in a market where costs are sky-high, competition is fierce, and everyone's scrambling for a slice of the customer pie. Not exactly a recipe for success, right? So, Jumia's pulling the plug on its food delivery ops in Nigeria, Kenya, Uganda, Morocco, Tunisia, Algeria, and Ivory Coast. As for Jumia's financial health? They've been on a loss-shedding spree, cutting down their third-quarter losses by 67% compared to last year.

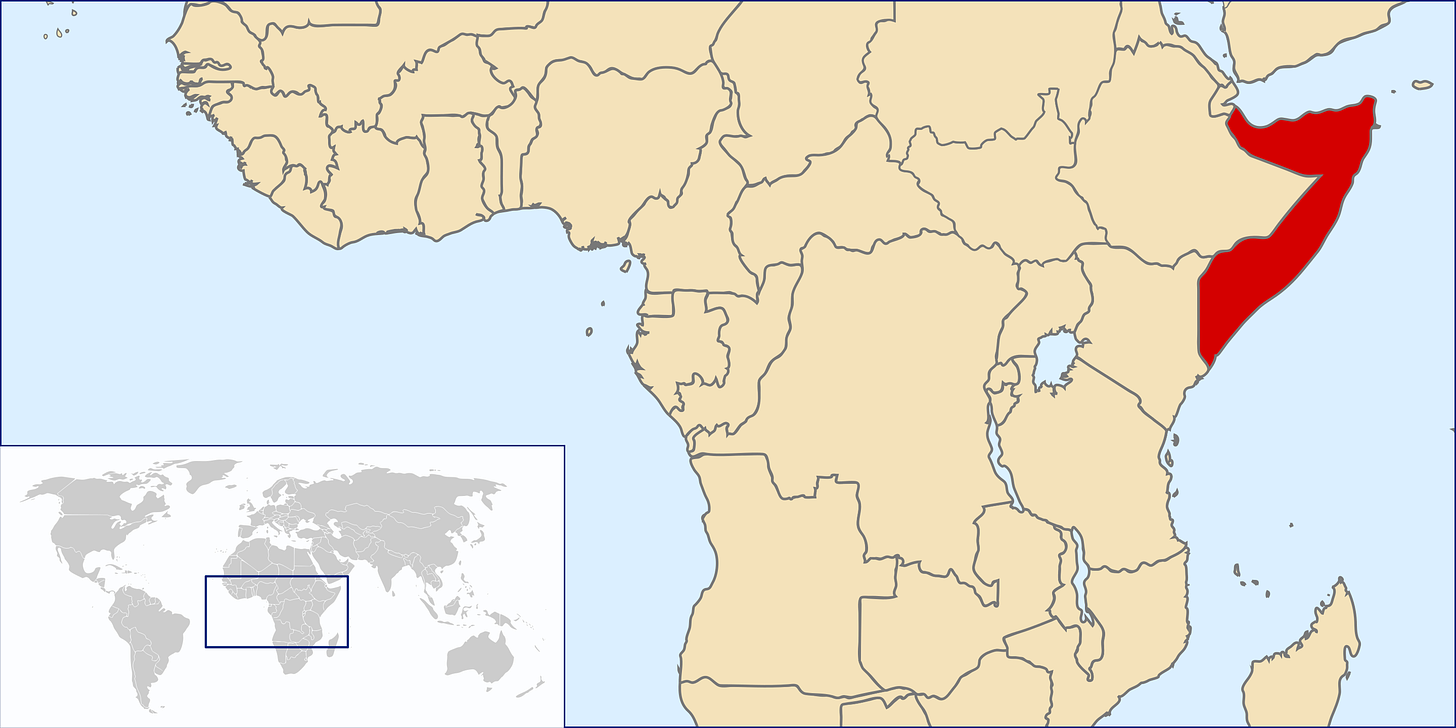

Somalia's Debt-Free Dance: Celebrating a $4.5 Billion Relief

It's party time in Mogadishu! Somalia just got a massive financial makeover, courtesy of the IMF and World Bank, to the tune of $4.5 billion. Imagine every Somali citizen having a $300 debt vanishing into thin air – that's what's happening. Prime Minister Hamza Abdi Barre is practically doing cartwheels, proclaiming Somalia as the new poster child for financial viability and a magnet for foreign investment. The debt relief is part of the Heavily Indebted Poor Countries (HIPC) program, designed to rescue the poorest countries drowning in debt. Here's a staggering number for you: Somalia's external debt plummeted from 64% of GDP in 2018 to less than 6% by the end of 2023: financial nightmare to dreamland in five years! The Horn of Africa country is trying to achieve political stability with transitions such as the one that ushered in Hassan Sheikh Mohamud in 2022, despite setbacks including an ongoing insurgency by al-Shabab. The extremist group, which opposes the federal government, still controls large parts of rural Somalia.

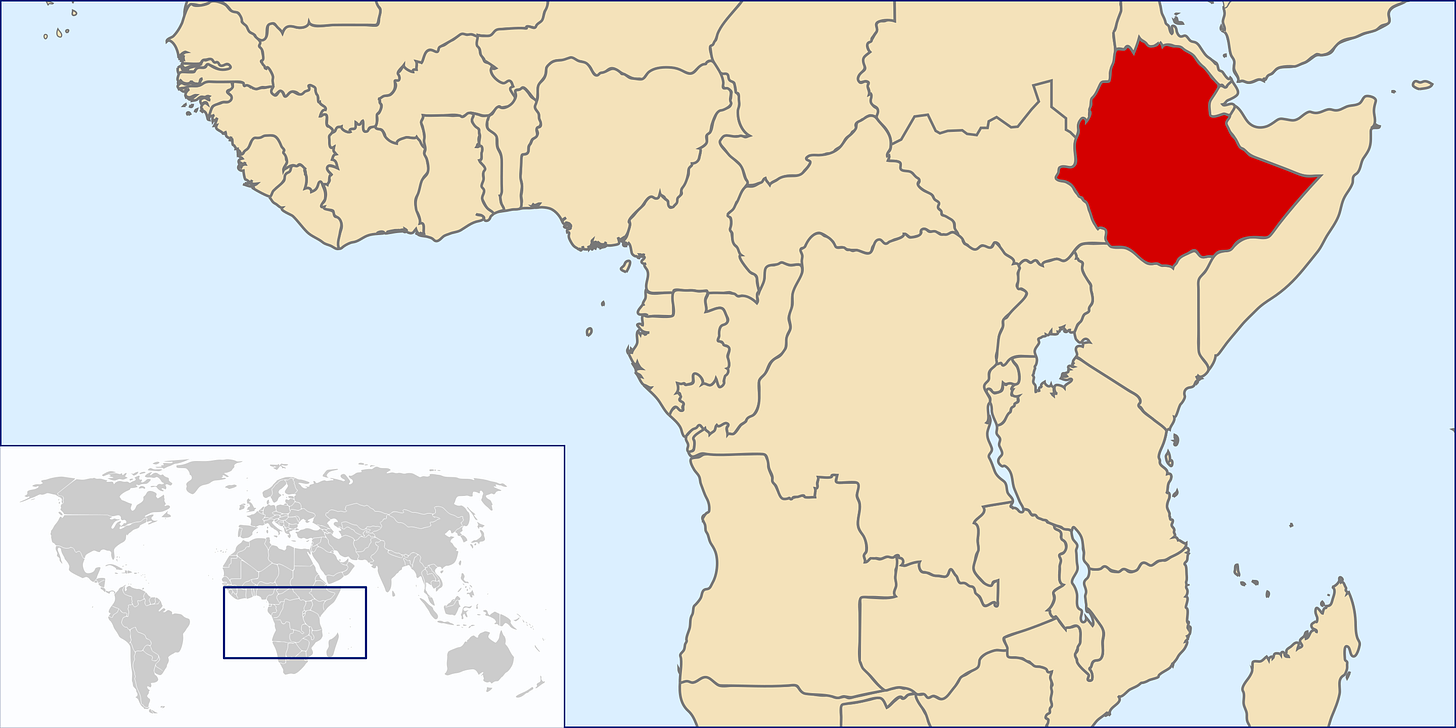

Ethiopia's Economic Tightrope: Debt Dilemmas and Default Dangers

Ethiopia, once the darling of Africa's investment scene, is now teetering on the edge of a financial cliff. Picture this: a $1 billion bond crisis, with the government unable to cough up a $33 million interest payment. The crisis is not only down to the pandemic; the country's been wrestling with a costly two-year northern civil war, and the price tag for rebuilding is a cool $20 billion. So, what's the government's game plan now? A Hail Mary investor call with a restructuring proposal that's already been given the thumbs down. It's like asking for a second date after the first one was a disaster. Ethiopia's also trying to sweet-talk the International Monetary Fund (IMF) for emergency funds and some much-needed debt relief. But recent history’s lesson on debt restructuring is clear: it's a long, bumpy road filled with more plot twists than a telenovela. Ghana and Zambia got a lifeline from the IMF, but they're still playing a high-stakes game of financial Twister with their creditors. For Ethiopia, that's not exactly an encouraging sign.

Mozambique's Gas-Powered Piggy Bank: Launching a Sovereign Wealth Fund

Mozambique's lawmakers just hit the jackpot, giving the green light to a brand new sovereign wealth fund, all thanks to the country's recent foray into the liquefied natural gas (LNG) export biz. Think of it as Mozambique's own gas-fueled piggy bank! Now, Mozambique isn't exactly the richest kid on the block, with an annual economic output of just $16 billion. But with big players like Eni and TotalEnergies on board, they're set to see some serious cash flow. Finance Minister Max Tonela is like the proud parent here, forecasting a gas export revenue peak of over $6 billion yearly by the 2040s. The plan? To make sure this windfall doesn't just vanish like a puff of smoke. They want sustainable, long-term economic growth, and this sovereign wealth fund is their golden ticket. Mozambique has been working hard to regain economic trust after a 2016 "hidden debt" scandal that left its economy reeling. Tonela promises that this new fund will be the poster child for good governance, transparency, and accountability. The funding breakdown? For the first 15 years, 60% of the gas revenues go straight to the state, with 40% tucked away in the fund. After that, it's a 50-50 split between the state budget and the fund.

Senegal's Political Plot Twist: Court Reinstates Opposition Leader on Electoral Roll

In a dramatic turn of events, Senegal's opposition leader, Ousmane Sonko, might just be back in the presidential race, thanks to a recent court ruling. Despite being tangled in a web of legal battles, including libel and rape charges which he firmly denies, Sonko's been given a potential ticket back to the ballot box. The 49-year-old, who's been stirring up the political pot, was cleared of rape but found himself serving a two-year sentence for what's cryptically described as "immoral behaviour" towards those under 21. His arrest for insurrection and removal from the electoral roll had seemingly dashed his electoral dreams. But, hold your horses! A Dakar court has flipped the script, reinstating him on the electoral register. This could be Sonko's comeback moment for the February presidential showdown. He's no stranger to the race, having bagged third place in the 2019 election. But wait, there's more! The state isn't letting this go without a fight and is gearing up for an appeal. So, buckle up, because Senegal's political rollercoaster is far from over.

Food for Thought

“One may have two legs, but that does not mean one can climb two trees at the same time."

— Ethiopian Proverb