We Want to Hear from You!

As 2023 winds down, your thoughts can light up our path ahead…

We’re conducting a quick, 2-minute survey to give you a chance to shape the future of Baobab. Your perspectives are precious to us and will guide how we bring African stories to you in the new year.

P.S. Hurry, the survey closes in 3 days (Friday) when we’ll take a break for the year. This is your chance to influence your favorite African news source!

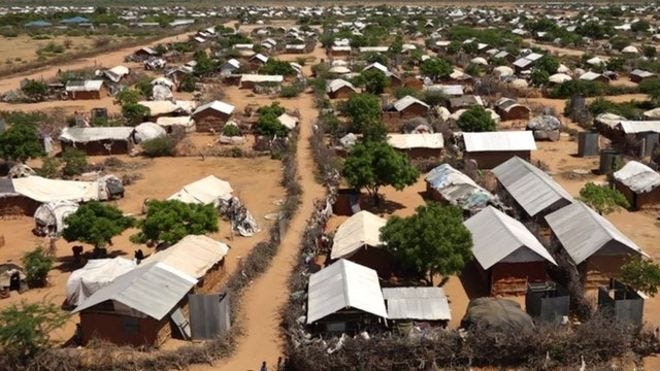

Photo of the day

Sierra Leone

Money Matters

🟢 Nigerian SE: 72,404.91 (+0.09%)

🟢 Johannesburg SE: 74,301.59 (+0.23%)

🟢 Ghana SE: 3,063.44 (+0.19%)

🔴 Nairobi SE: 89.99 (-1.29%)

🟢 US S&P 500: 4,762.66 (+0.47%)

🟢 Shanghai Composite: 2,932.39 (+0.05%)

*Data accurate as of the close of markets across the continent

Brief & Bright: Africa's Top Five

The Nigerian Businessman Accused of Orchestrating Multi-Billion Dollar Fraud

The US Securities and Exchange Commission (SEC) has brought serious charges against Nigerian businessman Dozy Mmobuosi, accusing him of conducting a "massive fraud" through his companies, including Tingo Group, Agri-Fintech Holdings, and Tingo International Holdings. Mmobuosi, also involved in a bid for an English Premier League football club, is alleged to have led a scheme that involved fabricating financial statements and inflating metrics of his companies and their Nigerian affiliates, Tingo Mobile Limited and Tingo Foods. The SEC's complaint describes the fraud as "staggering," with fabricated transactions amounting to billions of dollars since 2019. These activities reportedly resulted in hundreds of millions of dollars of non-existent revenues and assets. The allegations against Tingo, a fintech company claiming to serve 9 million users in Nigeria, primarily farmers, and running a food processing business, were initially fueled by a report from Hindenburg Research. This U.S.-based short seller labelled Tingo an “exceptionally obvious scam,” leading to a significant drop in the company's stock value. According to the SEC, Tingo Group reported over $461 million in cash and equivalents in 2022, but the actual balance was less than, hear this, $50.

Congo's Carbon Credit Crusade: dClimate's $1 Billion Forest Preservation Deal

dClimate, with backing from the likes of Mark Cuban, has just inked a preliminary deal to turn Congo's forest conservation into a cool $1 billion through carbon credits. They're eyeing about 500,000 hectares of peatlands in the Democratic Republic of Congo, promising to keep deforestation at bay for a decade. The plan? To sequester 100 million tons of CO2 and sell the resulting credits on the open market. Peatlands are carbon storage goldmines, trapping organic matter that would otherwise release carbon back into the atmosphere. Congo, sitting on the world's second-largest tropical forest, is a carbon-capturing powerhouse, with its forests soaking up 822 million tons of greenhouse gases annually. But here's the catch: for these credits to be worth their weight in green gold, dClimate needs to prove that their conservation efforts are the real deal. This concept, known as 'additionality', is crucial in the carbon credit game. It's about showing that the peatlands wouldn't have been saved without their intervention. Neighbouring countries like Gabon have hit roadblocks selling credits from lands that weren't directly under threat, raising questions about their environmental impact. Despite Congo's carbon-rich forests, the market scepticism is real. With ongoing debates about the true effectiveness of these offsets and a recent study suggesting only 6% of offset projects in preserved forests are making a real difference, Congo's credits are trading at a bargain rate of about $5 on the voluntary market. That's peanuts compared to credits in more regulated markets like the US and EU. Enter dClimate with their high-tech monitoring and a new carbon-credit registry, aiming to boost investor confidence and fetch a better price for their credits – think $7 to $10 each. They're planning to pocket 10% to 20% of the credit payments as a fee.

Uganda's Refugee Reality: A Complicated Tapestry

Uganda's approach to hosting refugees, often lauded as a model by the United Nations and Western media, is facing a reality check. The country, co-hosting the 2023 Global Refugee Forum, has become a sanctuary for 2.4 million refugees from the DRC, Somalia, South Sudan, and beyond. They find safety in Uganda but can struggle with dire circumstances, raising questions about the West's portrayal of the "Uganda Model." Uganda's 2006 Refugee Act embodies a progressive stance with an “open-door” policy, granting refugees the right to work, freedom of movement, and access to public services. This approach, rooted in Pan-Africanism and President Museveni's own displacement experience, contrasts starkly with the West's often harsh refugee policies. Settlements like Bidi Bidi and Nakivale, rather than camps, allow refugees to integrate into local communities. However, the influx of refugees, especially from South Sudan since 2016, has strained resources and infrastructure. While locals initially welcomed refugees, aiding them with land and support, the growing population has led to tensions and challenges. You can read more on this in this piece.

EU's New Deforestation Law Affects African Coffee Farmers

The EU's upcoming Deforestation Regulation (EUDR), set to be enforced in late 2024, is causing ripples in the global coffee market, particularly impacting small-scale African farmers. This regulation requires importers of commodities like coffee to prove that their products don't originate from deforested land, under penalty of hefty fines. Ethiopian coffee, vital for about 5 million farming families, is already seeing a decline in orders. Major importers, wary of the new law's compliance demands, are hesitant to purchase from regions where proving the origin might be challenging. But this shift in sourcing strategies could lead to increased poverty among small-scale farmers and potentially raise prices for EU consumers. The EUDR aims to tackle deforestation, a leading cause of climate change, by mandating companies to digitally map their supply chains down to the plot where raw materials were grown. However, this requirement is proving daunting, especially in developing countries with patchy internet coverage and complex local dynamics. While the European Commission is initiating support measures to help producers comply with the EUDR, including a 70 million euro fund, the transition is challenging. Many smallholders are unaware of the regulation, and collecting the required data is a significant hurdle. Major commodity producers like Ivory Coast, Ghana, Brazil, Vietnam, Indonesia, and Malaysia might not be entirely cut off due to their significant market share. However, some companies are considering redirecting non-compliant goods to non-EU markets, potentially undermining the regulation's environmental goals. As a result, the EUDR, while well-intentioned, is having unintended consequences. It's reshaping global commodities markets, potentially marginalizing small-scale farmers, and might lead to segregated supply chains with varying compliance levels.

Conakry Oil Terminal Explosion: Tragedy in Guinea's Capital

Guinea's capital, Conakry, has been rocked by a massive explosion at its main oil terminal, resulting in tragic loss of life and widespread panic. At least eight people have been confirmed dead, and the number of injured ranges between 84 and 100, marking a significant catastrophe in the city. The explosion, which occurred in the middle of the night earlier this week, shattered windows of nearby houses and sent residents fleeing in fear. The exact cause of the fire that led to the explosion remains unclear. Hours after the initial blaze, the fire continued to rage, with its smoke visible from miles away. In response to this disaster, the authorities have taken immediate action. Schools have been closed, and residents are advised to stay at home. The destroyed oil depot, according to Mr. Diallo, is of strategic importance to Guinea, as it supplies fuel to a significant part of the country. The explosion not only represents a human tragedy but also a substantial logistical challenge for the nation.

Food for Thought

“A bird does not change its feathers because the weather is bad."

— Kenyan Proverb