🔅 China Is Not the Only Culprit for Africa's Debt, World Bank To Bail Out South Africa

Plus, Zambia's Restructuring Deal & Liberia's Presidential Election Heads to a Run-Off

Photo of the day

Luanda, Angola

Markets:

🔴 Nigerian SE: 67,084.95 (-0.18%)

🔴 Johannesburg SE: 70,274.34 (-0.49%)

— Ghana SE: 3,131.99 (0.00)

🔴 Nairobi SE: 89.59 (-0.26%)

🔴 US S&P 500: 4,144.34 (-1.01%)

🟢 Shanghai Composite: 2,988.30 (+0.48%)

*Data accurate as of the close of markets across the continent

Brief & Bright: Africa's Top Five

China Isn't the Only One to Blame for Africa's Debt

China isn’t the main cause of debt distress in sub-Saharan Africa. According to the IMF, China’s share of the region’s external public debt has risen from less than 2% to 17% in the past two decades—but that’s not the whole story. Domestic commercial borrowing and loans from multilateral lenders make up the majority of the debt, and China’s share in sub-Saharan Africa’s overall sovereign debt is only 6%. So, while Beijing may be the biggest bilateral lender, it’s not the only one to blame for the debt overhang in Africa. As much as 60.9% of the region’s public debt is from domestic commercial borrowing, which comes with higher interest rates and shorter maturity periods, and multilateral lenders hold 13.7%.

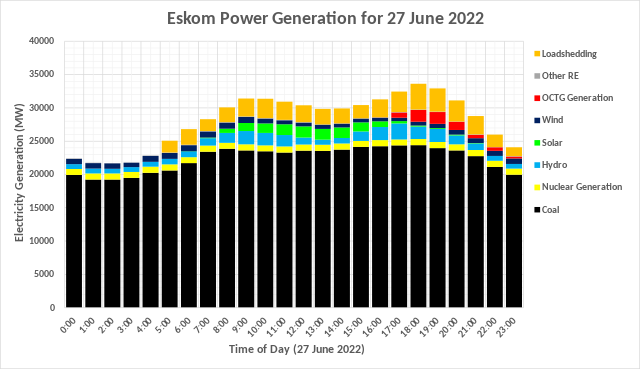

South Africa's Energy Crisis: The World Bank Steps In with a $1 Billion Loan

South Africa is in a bit of a pickle—rolling blackouts, pollution from coal-fired power stations, and delays in meeting climate change targets. But don’t worry, the World Bank says it is here to save the day with a $1 billion loan to help address the energy crisis. The country is the most advanced economy in Africa and the 16th largest emitter of greenhouse gases in the world. That’s why it says it needs $80 billion over the next five years to switch to greener energy sources. The World Bank has already given them $439.5 million to convert a former power station into a renewable energy provider. The World Bank has been urged to provide more money to African countries to facilitate its transition to greener sources of energy and facing climate change-induced problems.

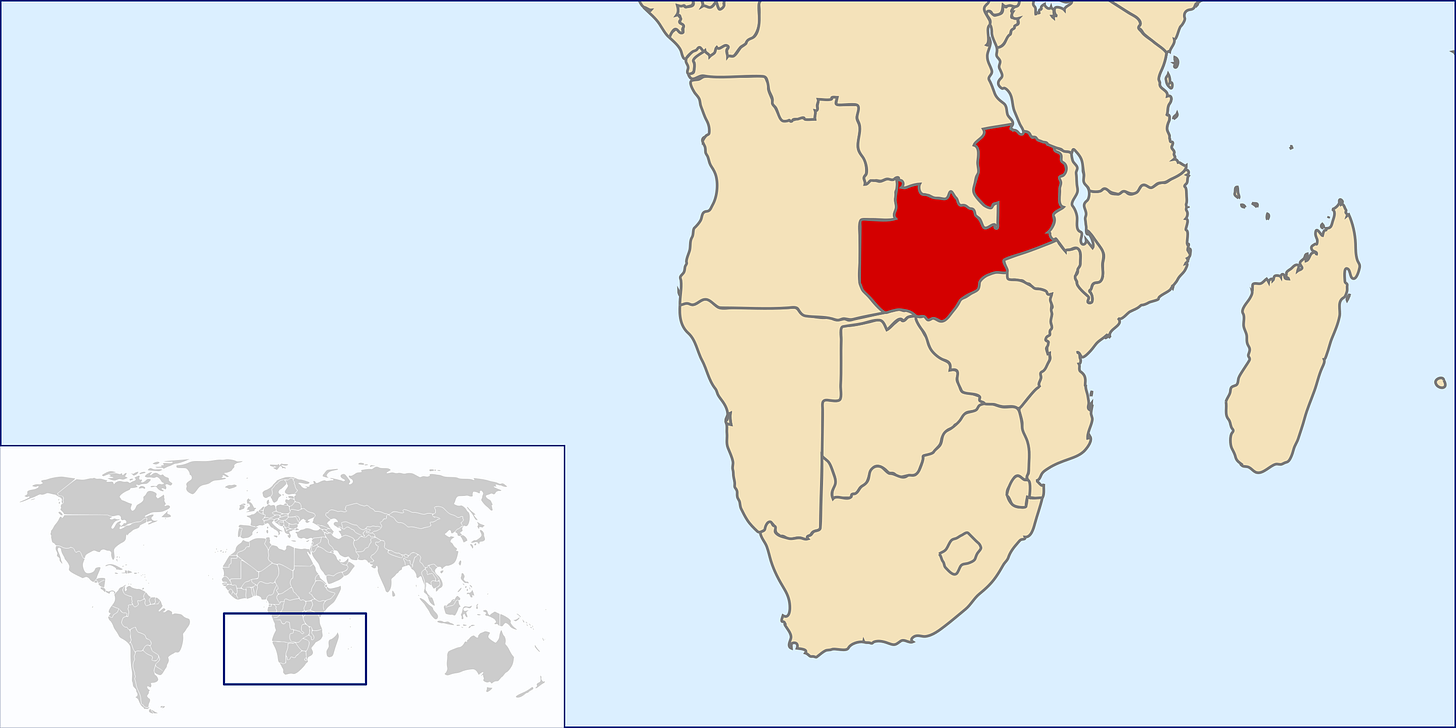

Zambia’s Restructuring Deal: Less Debt, More Time to Pay, and a Higher Chance of Economic Success

It’s official: Zambia has finally reached an agreement on restructuring its debt with a group of creditors. This means the country’s three international bonds will be restructured into two new bonds that will mature in 2035 and 2053, with a potential 18% haircut for the creditors. If the economy does better than expected, the bonds will mature in 2035. This is a big win for Zambia, which was the first African country to default during the pandemic and has been struggling to negotiate with its creditors, including China. The deal will also give Zambia more cash flow relief and allow for better access to international capital markets. Plus, it incentivizes economic success with a potential for quicker payouts to bondholders if the country’s debt capacity increases or hard-currency revenues exceed IMF projections.

Liberia's Presidential Election Heads to a Run-Off

Liberia's election commission has announced a run-off election for November after neither President George Weah nor opposition leader Joseph Boakai secured enough votes in the first round. Weah, a former soccer star, is narrowly leading with 43.83% of the vote, while Boakai has 43.44%. The run-off is set to be a test of support for Weah, who has been criticized for not doing enough to fight corruption and rebuild the country's economy and infrastructure. Meanwhile, Boakai is campaigning on the promise to rescue Liberia from alleged mismanagement under Weah's administration.

The Great Escape: Miners Resurface After An Underground Union Standoff

After three days underground, more than 550 miners have emerged from a gold mine in South Africa. The reason for their extended stay? A union dispute. Some miners claimed they were held against their will by fellow employees who wanted their unregistered union to be recognized. But the mine owners and police called it a hostage situation. Police had taken a cautious approach, not wanting to confront the miners underground. This isn’t the first time union rivalries have caused chaos in South African mines—in 2012, 34 miners were shot dead by police during a strike, and a rivalry between these two unions was partly to blame.

Food for Thought

"By the time a fool has learned the game, the players have dispersed."

— Ashanti Proverb